Like most economies around the world, Nigeria’s economy has been hit hard by the impacts of the Covid-19 pandemic. According to figures from the World Bank, in 2020 the country recorded its deepest quarterly contraction since the 1980s at about -6% in the second quarter. Oil exports in 2020 fell by around 43% and fiscal revenues by as much as 28%.

Although the Nigerian economy grew by 3.4% in 2021, more than 5 million Nigerians will have fallen into poverty by 2022 due to the impacts of the Covid-19 pandemic. More than one-third of the labour force continues to be without employment or underemployed.

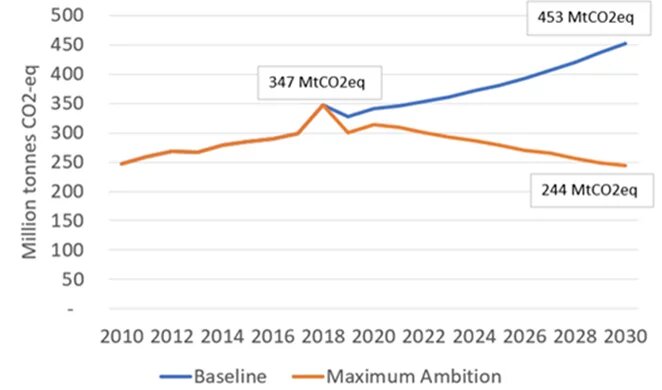

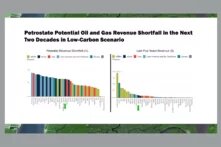

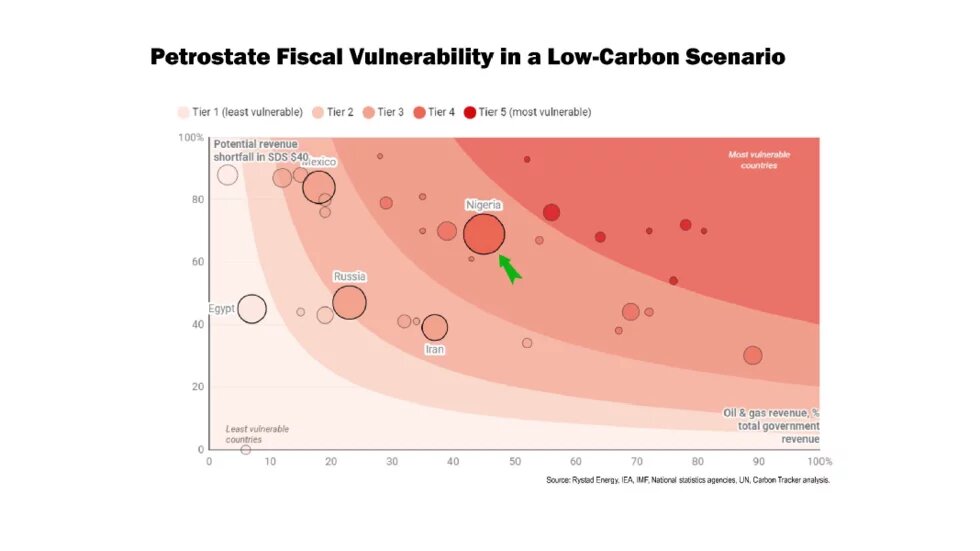

The medium to long-term economic outlook for Nigeria is equally concerning. Although global energy prices are surging at the moment, the pace of the global energy transition away from fossil fuels is set to accelerate. A 2021 report by the think tank Carbon Tracker estimates that fossil fuel reliant countries could see a drop of 51% in government oil and gas revenues in a shift to a low-carbon world over the next two decades.

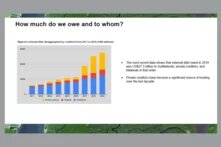

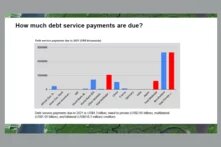

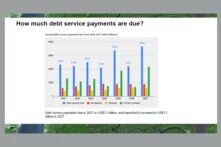

Even before the economic impacts of the Covid-19 pandemic hit, the country’s debt already stood at historically high levels having more than doubled from 12.6 trillion Naira in 2015 to 27.1 trillion Naira at the end of 2019. By June 2021 this figure rose to about 39 trillion Naira. Whilst the debt-to-GDP ratio remains below the self-imposed 40% mark, debt servicing costs have reached worrisome levels. In 2021, Nigeria at the federal level spent an estimated 76% of its revenue on service debt.

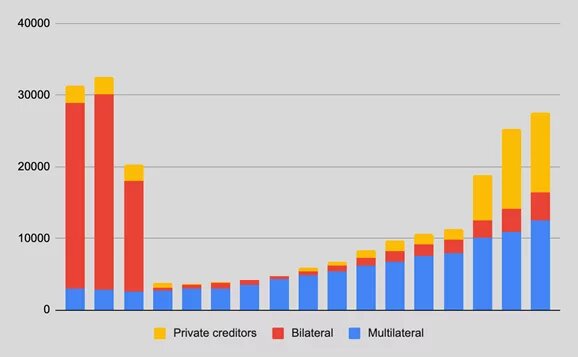

Although the external to domestic public debt ratio has remained favorable at about 40:60, the structure of Nigeria’s external debt has fundamentally changed with commercial debt now making up a large chunk (about 40%) compared to the early 2000s. Bi-lateral debt is largely owed to China as opposed to the countries of the Paris Club.

Not least due to the large debt burden, Nigeria lacks the fiscal ability to fulfill its commitments to achieve the Sustainable Development Goals (SDG) and to contribute to the attainment of the climate goals of the Paris Agreement. What the United Nations framed as a ‘Decade of Action’ is starting with Nigeria and many other countries regressing instead of making accelerated progress.

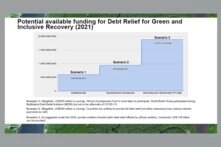

Against this backdrop, the Heinrich Böll Foundation Abuja Office in collaboration with the Centre for the Study of Economies in Africa, the Centre for Climate Change and Development, and BudgIT have developed a presentation that makes the case for debt relief for a green and inclusive recovery for Nigeria. It is inspired by a debt relief framework proposal for a green and inclusive recovery developed by the Heinrich Böll Foundation in collaboration with the Global Development Policy Centre and the Centre for Sustainable Finance at the University of London.

Debt Relief for a Green and Inclusive Recovery - Boston University Global Development Policy Center

Watch on YouTube

Watch on YouTube

To present and discuss their analysis and ideas, the above organisations invited select government stakeholders to a closed-door stakeholder engagement hosted in conjunction with the Nigeria Economic Summit Group.

Some of the key messages discussed at the meeting included

- Nigeria’s external debt is close to reaching pre-Multilateral Debt Relief Initiative (MDRI) levels. The country will be hard-pressed to achieve its developmental and climate commitments given the current fiscal constraints;

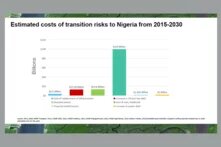

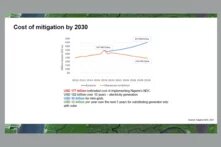

- The potential fiscal impact of the physical and transition risks of climate change is enormous, and so is the cost of the necessary mitigation and adaptation measures;

- A debt relief for a green and inclusive recovery initiative could contribute to the solutions. Under such an initiative Nigeria would be granted debt relief in return for clear and measurable commitments and investments into programmes and projects towards the achievement of the Sustainable Development Goals (SDGs) and Paris Climate Agreement;

- Stringent transparency and accountability measures would need to be put in place to ensure the developmental impact of any debt relief measures.